Insurance coverage Alternative: The Ultimate Guidebook to Knowledge and Deciding on the Correct One

When was the final time you thought of your insurance policies? Or improved nevertheless, when was the final time you actually recognized what your insurance policy is carrying out for you? In case you are like the majority of people, insurance plan might seem similar to a tedious, avoidable expenditure. But This is the issue – It really is a thing that can make or break your fiscal stability. You require the ideal insurance policy Resolution, and we are listed here to dive deep into why That is so important.

7 Easy Facts About Insurance Solution Explained

Permit’s start off by breaking down what we necessarily mean by “insurance Remedy.” Primarily, it’s the best match concerning your individual or enterprise demands and the right style of insurance plan protection. A very good insurance policy Answer isn’t almost purchasing a little something you don’t want, it’s about securing your relief when daily life throws sudden curveballs your way. Whether you’re seeking wellness insurance policies, automobile insurance, property coverage, or anything far more specialised, the right insurance coverage Answer might make a tremendous variation.

Permit’s start off by breaking down what we necessarily mean by “insurance Remedy.” Primarily, it’s the best match concerning your individual or enterprise demands and the right style of insurance plan protection. A very good insurance policy Answer isn’t almost purchasing a little something you don’t want, it’s about securing your relief when daily life throws sudden curveballs your way. Whether you’re seeking wellness insurance policies, automobile insurance, property coverage, or anything far more specialised, the right insurance coverage Answer might make a tremendous variation.But How can you locate the ideal insurance policies Option? Is it as simple as selecting a system that sounds excellent, or is there more to it than that? Spoiler notify: there’s far more. Knowing the details, fantastic print, and coverage solutions accessible to you is very important. So, Enable’s take a further dive.

Very first, you’ve received to determine which kind of insurance policies you need. In the event you’re someone, this could imply overall health coverage, existence insurance policy, or car insurance policies. In case you run a company, matters get a tad additional complex. Commercial insurance is important for masking liabilities, assets, personnel, and even your enterprise’s track record. An insurance plan Resolution should be personalized to deal with every one of these threats and supply the safety you require. You wouldn’t push an auto with out a seatbelt, proper? Effectively, think of insurance plan as your financial seatbelt.

One of the more important areas of obtaining the ideal insurance policies Alternative is comprehension the dangers you encounter. For example, do you live in a place that’s prone to flooding? If that's the case, flood coverage can be something you must contemplate. Or even you’ve bought a relative who relies on you for support – in that scenario, lifestyle insurance could offer a very important safety net. The real key will be to evaluate your own or company threats and align your protection with All those things. Think about insurance policies being a protect that guards you against the unknown.

Naturally, getting the best insurance coverage solution isn’t almost buying coverage that guards you. It’s also about finding a supplier you have confidence in. The connection you have with the insurance provider is equally as vital as the merchandise they provide. A superb insurance company must be responsive, straightforward to operate with, and clear about their policies. They must help you realize Whatever you’re having and make sure that you’re not overpaying for needless protection. When your insurance company doesn’t make you really feel safe, Then you really’re likely not in the ideal hands.

Now, Enable’s take a look at Value. Coverage is undoubtedly an price, there’s no receiving all-around it. But the best insurance coverage Remedy doesn’t necessarily mean breaking the lender. Guaranteed, you can get The most affordable plan, but that doesn’t always supply you with the ideal value. It’s imperative that you Evaluate different options and think about what each one addresses. Consider the greater picture, and talk to yourself: will this plan safeguard me adequately in the crisis? Am i able to find the money for the deductible? Insurance plan methods are about stability – in between price tag, coverage, and comfort.

So, what exactly is included in a standard insurance plan Remedy? Most procedures incorporate fundamental coverage for a particular function, like damage to house or professional medical payments in case of an accident. But In addition there are optional insert-ons, called endorsements, which often can enhance your protection. For illustration, you may want to insert an umbrella policy for additional legal responsibility protection or involve protection for Exclusive merchandise like jewellery or electronics. When it comes to an insurance plan Remedy, don’t just accept the basic bundle. Dig further and check out these incorporate-ons to ensure you’re absolutely lined.

In case you’re baffled about what your insurance coverage coverage handles, you’re not on your own. Plenty of individuals have difficulties knowledge the specifics, Specially On the subject of exclusions and limits. This is where dealing with a professional insurance coverage broker can come in useful. A broker will help you decipher the sophisticated phrases, make clear your options, and manual you toward the ideal insurance coverage Resolution on your scenario. Visualize them for a translator, serving to you understand the language of insurance policies.

Now, Enable’s touch on the different sorts of insurance policy options readily available. For individuals, overall health insurance coverage is commonly A very powerful. But Were you aware that It's also possible to get crucial disease insurance policy or dental insurance coverage as portion of your healthcare package? These sorts of specialised coverage can shield you in ways in which primary wellness insurance won't. In the same way, house coverage is a necessity for homeowners, but you will find distinctive sorts, like renter’s insurance or flood insurance plan. It’s all about matching the ideal kind of coverage to your requirements.

9 Simple Techniques For Insurance Solution

Alternatively, businesses frequently demand a additional complex insurance Option. Industrial insurance policies insurance policies commonly cover things like liability, assets injury, worker’s payment, and organization interruption. But based upon your business, you would possibly need to have specialised protection likewise. As an example, in the event you’re inside the tech marketplace, you might require cyber insurance to guard towards facts breaches. For those who’re in building, you might need builder’s risk insurance policies to address any damages for the duration of a task. Whatever style of company you run, there’s an insurance Resolution around for you personally.Once you obtain the appropriate insurance policy Remedy, it’s a tremendous fat off your shoulders. Recognizing you’re coated can supply you with the freedom to give attention to what genuinely matters in life, like investing time with family or expanding your enterprise. Visualize a entire world in which you don’t have to worry about what would happen if you got Unwell, had an accident, or professional An important financial setback. That satisfaction is priceless, and it’s what a reliable insurance policies Option gives.

But don’t just visualize insurance coverage as being a “established it and neglect it” point. On a regular basis examining your insurance coverage solution is just as crucial as acquiring the proper one particular to start with. Your life variations, and so do your insurance plan needs. Possibly you’ve gotten married, experienced Young children, or moved into a bigger dwelling. Each individual of such milestones could have an effect on your coverage. That’s why it’s important to sign in with your insurer periodically to verify your plan nonetheless suits your Way of life and delivers the security you'll need.

Another detail to think about is the way forward for insurance. Together with the increase of engineering, the insurance plan industry is undergoing significant variations. From electronic guidelines to using AI in underwriting, the future of insurance answers has become additional customized, economical, and client-helpful. So, keep an eye on new traits and innovations, since what operates today might not be the best choice within a several years. Being informed about these modifications can assist you keep on to help make good conclusions regarding your insurance plan.

Insurance Solution Things To Know Before You Buy

Any time you get right down to it, the ideal insurance plan Alternative is about understanding your self, your risks, and your needs. It truly is about getting a company that you rely on and one which’s about to provide you with the finest coverage in a price that works for your personal budget. And when you finally’ve identified that fantastic Option, don’t neglect to check in regularly. Your lifetime plus your dangers are generally changing, so it’s important to remain proactive. With the correct insurance Remedy, you are able to facial area the future with self esteem, realizing that it doesn't matter what happens, you’ve bought a security Web to capture you.

Coverage isn’t just a product, it’s an answer to the uncertainties of lifetime. The top coverage Resolution isn’t about shopping for the costliest policy or perhaps the 1 with essentially the most bells and whistles. It’s about knowing your individual desires and challenges, getting a coverage that matches, and remaining geared up for whichever lifestyle might throw your way. The correct Remedy can provde the reassurance to Stay your life without the need of continuously stressing about what could go Mistaken.

In Find out more the end, selecting the right insurance plan solution is like building a good foundation to your potential. With the correct coverage, you’re not simply safeguarding you from lifetime’s surprises; you’re guaranteeing that you just’ll contain the sources to get better in the event the unanticipated occurs. So make the effort to locate the coverage Answer that actually works most effective to suit your needs. It’s an financial investment with your foreseeable future, and one which can pay off in ways you are able to’t constantly forecast.

Your insurance solution isn’t just a piece of paper – it’s your safety Internet, your backup strategy, along with your stability. Whether you’re seeking for personal or business enterprise insurance policies, View more there’s not one person-size-fits-all solution. By taking the time to be aware of your requirements and threats, and by getting an insurance provider you trust, you’ll be inside a significantly better place to confront the longer term with self confidence. Remember, insurance coverage isn’t pretty much protecting matters – it’s about protecting you and those See details you like.

Sam Woods Then & Now!

Sam Woods Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Mary Beth McDonough Then & Now!

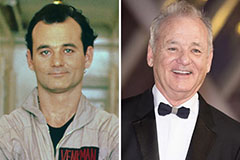

Mary Beth McDonough Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!